System Of Compulsory Social Health Insurance

Скачать файл:

PRESENTATION CSHI (pdf файл -861 kb)

The system of compulsory social health insurance is a state system of social protection of interests in the field of health protection.

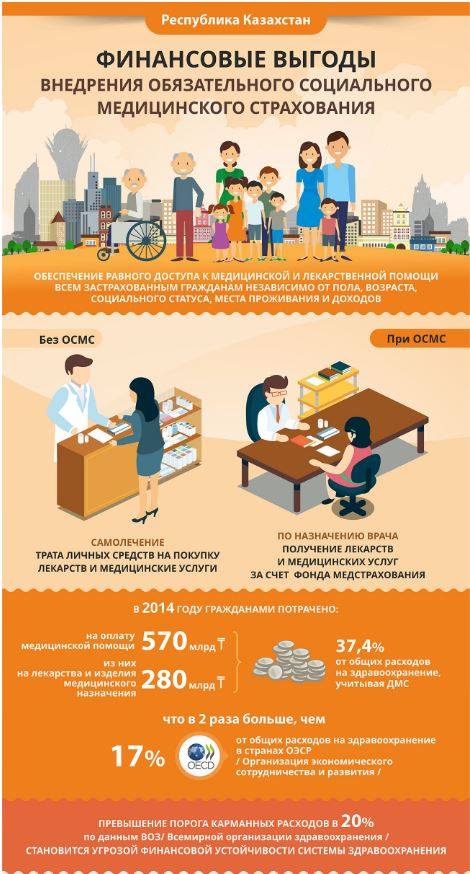

Compulsory social health insurance (OSMS) guarantees all insured citizens of Kazakhstan, regardless of gender, age, social status, place of residence and income equal access to medical and drug care at the expense of the social health insurance Fund.

THE MAIN GOALS OF THE CSHI

1. Achieving social solidarity by promoting one's own health and sharing the burden of protecting the health of the population.

2. Ensuring the financial stability of the system by creating the system's resilience to external factors and cost increases, as well as transparency and fairness of the system.

3. Improving the efficiency of the system by ensuring high competence and competitiveness of the system, achieving the final results of availability, completeness and quality of services.

THE PRINCIPLES OF THE CSHI

- UNIVERSALITY

All permanent residents (universal coverage) are required to participate in the OSMS system and each of them must pay contributions (or the state pays for it)

- SOCIAL JUSTICE

Contributions for the economically active population depend on solvency, i.e. income, and contributions for the economically inactive are paid by the state budget from General taxes

- SOLIDARITY

Each insured person has the right to medical care paid by the OSMS regardless of the amount of contributions paid.

OBLIGATORY PAYMENTS TO THE CSHI

THE CONTRIBUTIONS OF THE STATE TO CSHI

The state from the average monthly salary preceding two years of the current financial year, determined by the authorized body in the field of state statistics will deduct from July 1, 2017 – 4%, from January 1, 2018 – 5%, from January 1, 2023 – 6% and from January 1, 2024 – 7%.

DEDUCTIONS OF EMPLOYERS ON CSHI

The employer from the expenses paid to the worker in the form of the income (salary), will pay since January 1, 2017 – 2%, since January 1, 2018 – 3%, since January 1, 2019 – 4% and since January 1, 2020 – 5%.

EMPLOYEE CONTRIBUTIONS TO THE CSHI

Contributions of employees from income (wages) accrued by employers will be from 1 January 2019 – 1% and from 1 January 2020 – 2%

CONTRIBUTIONS OF THE SELF-EMPLOYED TO CSHI

Calculation and payment of contributions of individual entrepreneurs, private notaries, private bailiffs, lawyers, professional mediators from January 1, 2017 – 2 % from 1 January 2018 to 3% from 1 January 2019 5% from 1 January 2020, 7% will be:

— for individual entrepreneurs applying the generally established tax regime: from income received by them as a result of entrepreneurial activity, taking into account deductions

— for individual entrepreneurs applying a special tax regime for a small business entity: from the size of one minimum wage

— for private notaries, private bailiffs, lawyers, professional mediators: from all types of income

CATEGORY OF CITIZENS EXEMPT FROM PAYMENT OF CONTRIBUTIONS

According to the law "about CSHI" 15 categories of citizens are exempted from payment of contributions to the Fund:

- children;

- mothers with many children;

- participants and invalids of the second world war;

- invalids;

- persons registered as unemployed;

- persons studying and being brought up in boarding organizations;

- persons enrolled in full-time education;

- persons who are on leave in connection with the birth, adoption (adoption) of a child;

- non-working pregnant women, as well as non-working persons actually raising a child before the age of three years;

- pensioners;

- military;

- employees of special state bodies;

- law enforcement official;

- persons serving a sentence under a court sentence in institutions of the criminal Executive system;

- persons serving a sentence under a court sentence in institutions of the criminal Executive system.

PROVISION OF MEDICAL CARE TO FOREIGNERS

In the current situation in Kazakhstan GOBMP is not provided:

- Foreigners and their family members permanently residing in the Republic of Kazakhstan with a residence permit

- Stateless person

- Foreigners temporarily residing in the Republic of Kazakhstan

Foreigners and stateless persons permanently residing in the territory of the Republic of Kazakhstan, as well as oralmans enjoy rights and bear obligations in the system of compulsory social health insurance on an equal basis with citizens of the Republic of Kazakhstan, unless otherwise provided by this Law.

Amendments to the SAM "on compulsory social health insurance" in the provision of medical care:

- Non-working oralmans and their family members for one year at the expense of state contributions (since the status of "oralmans" is granted for 1 year, if he does not receive citizenship during this period, he is considered as a " foreigner»;

- Non-working foreigners and members of their families permanently residing in the Republic of Kazakhstan on an equal basis with citizens of the Republic of Kazakhstan;

- Working foreigners and their families on a General basis.

THE MOVEMENT OF FUNDS CSHI

For inactive population on GOBMP and transfers to Fund (contributions on OSMS for the persons exempted from their payment) the state from the Republican budget pays. The funds are transferred monthly under the financing plan through the budget program Ministry of health and social development to the social health insurance Fund.

In turn, the contributions of the active population (employers, employees, individual entrepreneurs, private notaries, lawyers, mediators, etc.) will go to the social health insurance Fund through the State pension payment center. This will ensure the accounting of income by analogy with the current pension system and the State social insurance Fund, as well as give savings for the transfer of contributions.

It should be noted that the functions of verification of individual identification numbers of participants, return of erroneous payments, transfer of information to the Tax Committee for verification of work with defaulters and personal accounting will lie on the state tax service.

The social health insurance Fund will distribute the funds as follows: part will be sent to pay for services to health care entities, that is, to medical organizations, and part will be sent to the national Bank, which will invest the funds and fully manage the assets.

CALCULATION OF DEDUCTIONS AND CONTRIBUTIONS TO CSHI

The employer deducts contributions for employees from expenses paid to the employee in the form of income, that is, from the payroll before corporate income tax (CIT). Calculation and transfer of deductions/contributions of employees are carried out by the employer on a monthly basis.

Employees deduct contributions from income accrued by employers, that is, wages before deducting individual income tax (IIT). Calculation and transfer of contributions of physical persons are carried out monthly by tax agents with whom such contracts are signed.

Individual entrepreneurs deduct contributions from income received by them as a result of entrepreneurial activity before deducting individual income tax (IIT). Calculation and payment of contributions of SP are carried out by them independently by direct transfer of means through the State Corporation to the Fund account. In the case of an individual entrepreneur applying a special tax regime, income is the amount of one minimum wage.

It should be noted that for all categories, the authorized body has determined the income from which deductions and contributions are not paid,

- compensation for business trips and traveling nature of work;

- field allowance of workers;

- expenses related to the delivery of employees for training, benefits and compensation from the budget;

- allowance to leave for health improvement, payments to pay for medical services, at the birth of a child, for burial within 8 MHP, scholarships, insurance premiums.

In this case, the minimum size of the object of calculations/contributions may not be less than the minimum wage.

The monthly income accepted for the calculation of deductions/contributions should not exceed 15 times the minimum wage.

All contributions must be paid no later than the 25th day of the month following the reporting / income payment month.

MEDICAL PACKAGES

1. GOBMP package-includes a state-guaranteed amount of medical care and financed from the Republican budget (GOBMP). It will be available to all citizens of Kazakhstan and oralmans. It includes:

- ambulance and air ambulance;

- medical care for socially significant diseases and in emergency cases;

- immunization;

- outpatient care (APP) with outpatient drug provision (ALO) (for the unproductively self-employed population until 2020, i.e. before the introduction of universal Declaration).

- OSMS package – includes the amount of medical care in excess of the gobmp, financed by mandatory insurance contributions of the state, employers and employees to the OSMS Fund. It can be received by persons who are members of the OSMS. It includes:

- outpatient care (including ALO);

- stationary honey. assistance (except for socially significant diseases);

- inpatient care (except for socially significant diseases);

- restorative treatment and honey. rehabilitation;

- palliative care and nursing;

- high-tech assistance.

ASSESSMENT OF THE QUALITY OF MEDICAL SERVICES

Who will contribute to improving the quality of medical services?

The joint quality Commission (JCC) will:

- to improve the standards of medical education;

- improve clinical outcomes;

- to improve provision of medicines;

- to improve the standards of the quality system and availability of services in the health sector;

- monitor compliance with standards of quality and accessibility of medical services.

CCMPA will undertake state control, including:

- control over observance of standards in the field of health;

- verification of fatal cases, including at the request of the FSMS;

- checking complaints.

Health authorities (HHS) will:

- standardize the network and services of the health system;

- ensure implementation of diagnostic and treatment standards;

- encourage accreditation of medical organizations in the national and international accreditation system;

- to reduce the number of justified complaints of the population and conduct sociological research on the satisfaction of the population with the quality of medical services;

- ensure the effectiveness of external quality control and internal audit in medical organizations;

- to provide continuous professional development of medical workers and development of the system of independent assessment of competence of medical workers.

3. The Fund will carry out the audit on the basis of the concluded contract with the medical organization, including:

- examination of the volume and quality of treated cases;

- examination of the validity of the appointment of drugs and IMN;

- monitoring of indicators of the final result of suppliers ' activities.

According to the results of inspections, the Fund will form a database of medical organizations with positive and negative ratings.

EXPECTED RESULT

- Availability of quality medical care

- A health system capable of meeting the needs of the population

- Improving health, increasing life expectancy

- Expansion of outpatient drug provision

- Strengthening quality control of medical services

The decrease in the level of private expenditure (out of pocket) for health care.

BOOKLETS

|

|

alt="Home"/>

alt="Home"/>